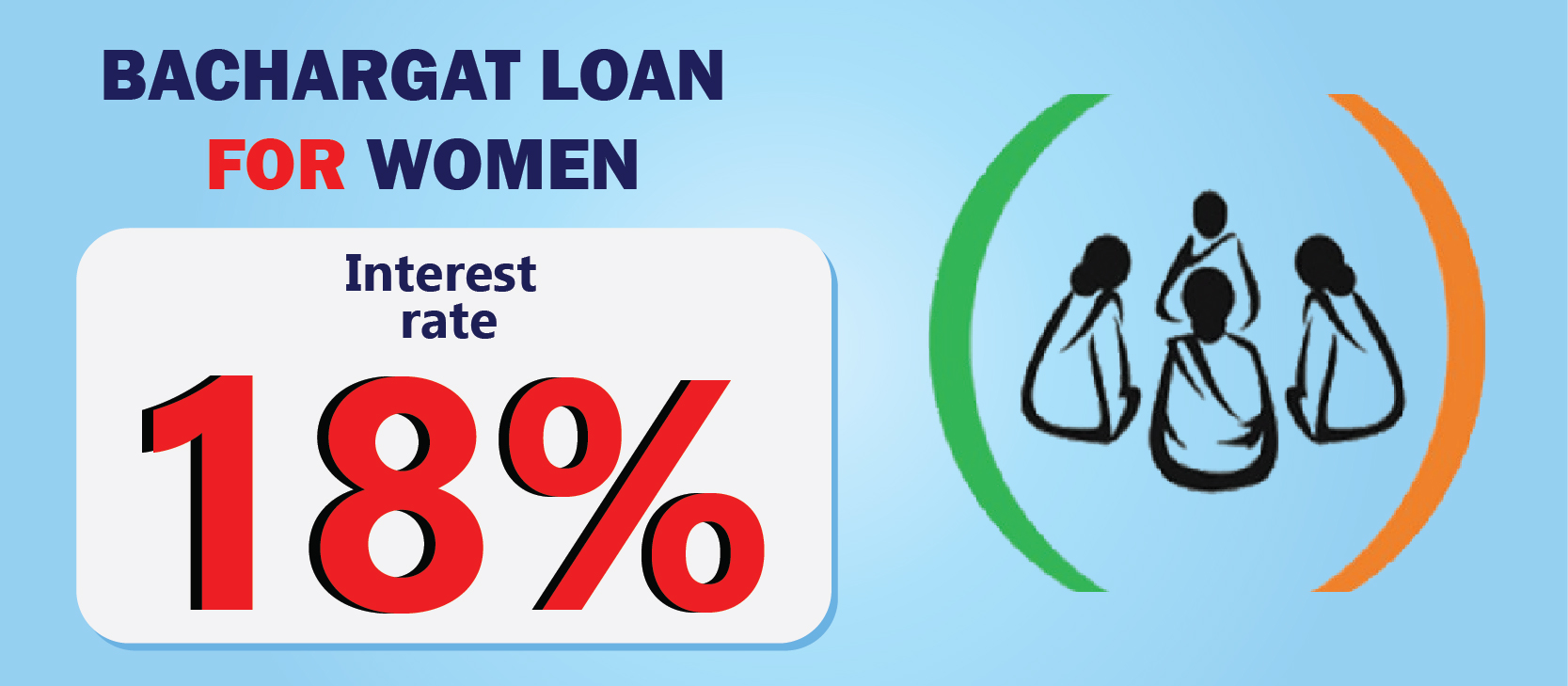

Bachatgat Loan for Women

Dnyankrupa Multistate’s Bachatgat Loan is specially designed to support women’s Self-Help Groups (SHGs) in building sustainable livelihoods. This loan helps members of Bachatgats access affordable credit for small businesses, household needs, or income-generating activities. With easy documentation, flexible repayment terms, and low interest rates, it encourages financial independence and group solidarity. It’s a step toward empowering women in rural and urban communities through responsible credit and collective savings.

Aspects

- 1. Loan to Registered Women’s Bachatgat / SHG

- 2. Encourages collective economic empowerment

- 3. Flexible loan amount based on group activity and repayment capacity

- 4. Joint liability model among group members

ROI & Handling Charges

- 1. Rate of Interest is 18%.

- 2. Loan Amount: ₹50,000 to ₹5,00,000 (depending on group size and need)

Eligibility

- 1. Registered Women’s Self-Help Group (Bachatgat)

- 2. Group must be active for minimum 6 months

- 3. Minimum 5 members required in the group

- 4. Regular group savings and meeting records

Documentation & Security

- 1. SHG Registration Certificate / Group Resolution

- 2. Aadhaar Card & PAN of group members

- 3. Group Account Passbook

- 4. Income and Activity Details

- 5. Group Meeting Register & Savings Record