FIXED DEPOSIT

Dnyankrupa Multistate Co-operative Credit Society Ltd. offers attractive and secure fixed deposit schemes with competitive interest rates, ensuring steady returns for customers. Senior citizens, widows, and differently-abled individuals benefit from higher interest rates. With a range of flexible tenure options and special deposit plans, customers can choose schemes that best suit their financial goals. The deposits are safe, backed by a trusted co-operative institution, making it a smart choice for long-term savings.

Benefits

- 1. Simple investment product which offers safety and flexibility.

- 2. Minimum period of deposit: 30 days

- 3. No limit for Maximum period of deposit.

- 4. Minimum Amount of deposit is Rs.500.

- 5. No limit for maximum deposit amount.

- 6. Option of premature/partial withdrawal in case of any urgent funds requirement without penalty.

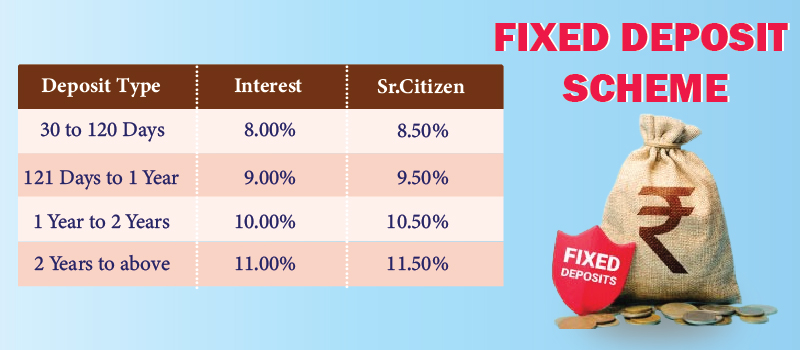

Rate of Interest

- 1. ROI ranges between 8.00% to 11.00% depending on tenure

- 2. 0.5% extra ROI for senior citizen.

Eligibility

- 1. Any individual who is resident of India.

- 2. No age limit.

Documents Required

- 1. Identity Proof of depositor.

- 2. Address proof of depositor.

- 3. In case of minor, guardian’s documents & signature is required.